New Year, New You: Renewing Your Insurance Plan

2019 is quickly approaching. For many businesses, that means it’s time to be thinking about health insurance renewals. Health insurance renewals are based upon the anniversary date of when the health plan coverage started. For many companies, this date is January 1st (but you will want to double check your health plan to be certain).

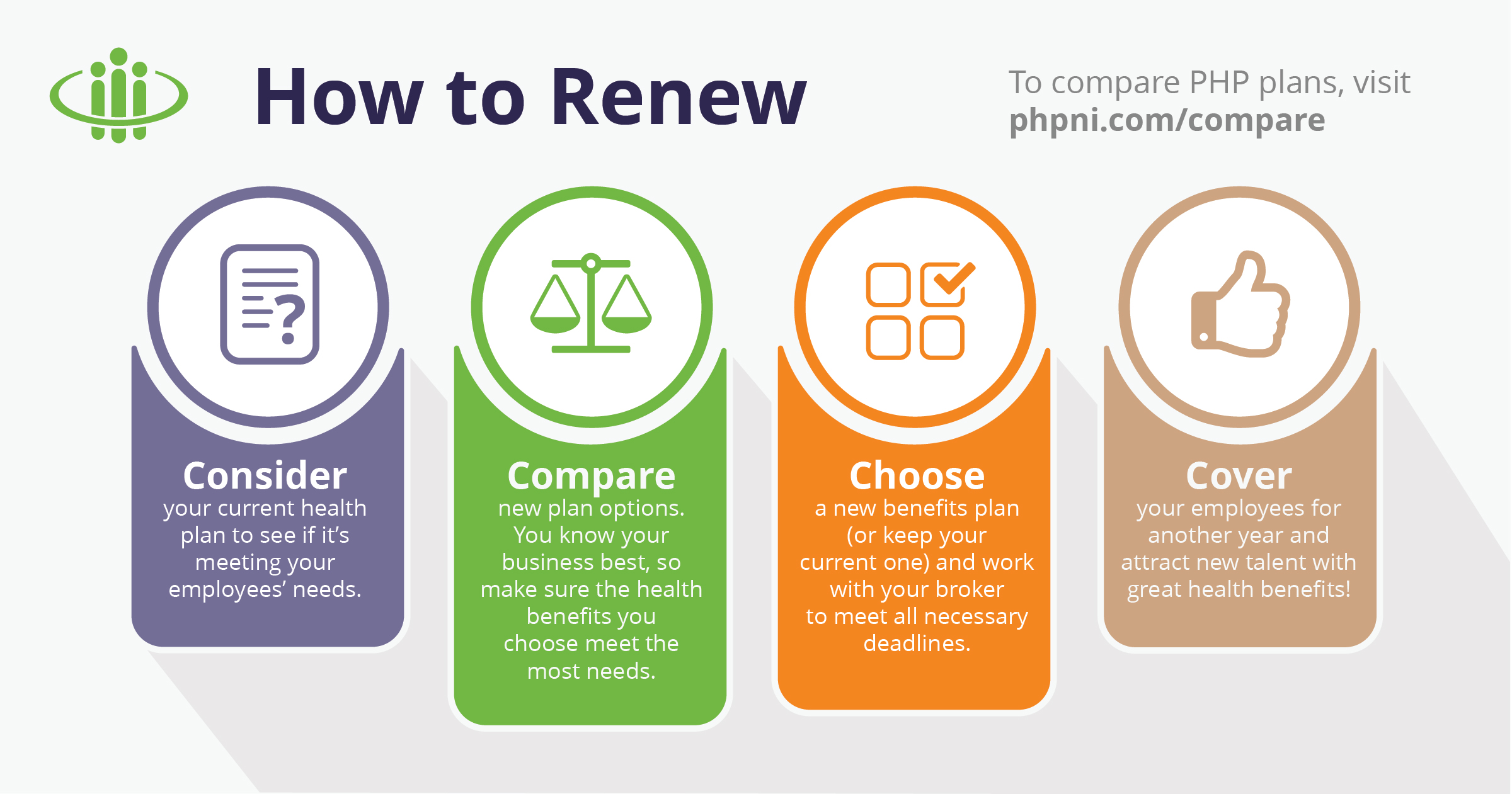

If your health insurance plan is coming up for renewal, it might be tempting to just say, “Yes, I want to renew!” Going along with the default renewal plan provided to you may not be the smartest move, however. Health insurance plans are constantly changing due to regulation changes and price fluctuations. Your business environment could be changing, too. Maybe your company has grown in the last year, or you’re facing more competitive benefit packages within your industry.

All of these changes—and many more—impact the type of health insurance plan that will work best for your company. That’s why it’s important (and necessary) to reevaluate your health insurance plan every year as an employer.

Leveraging the Renewal Process

The health insurance renewal process is a great opportunity for employers to realign their benefits package to better fit the needs of their company and employees. So before you simply say “Yes!” to a proposed health insurance plan, here are three things you may want to consider:

- Timing is everything.

The enrollment period for your health insurance will depend upon when your company’s health plan coverage went into effect. For many businesses, this date is January 1st, but that not always the case.

Whenever your enrollment deadline happens to be, experts recommend starting your health insurance renewal process 90 days before the deadline in order to leave ample time for you and your employees to do the necessary research and make the necessary decisions about health plan enrollment.

The renewal process is not always straightforward and simple. To do it justice, you need time for fact-finding and research. If you are rushing the process, you will not be able to take the time to listen to your employees and to truly find the best plan for your business. By starting early, you can work with your health insurance provider or broker to determine what deadlines must be met along the way while leaving ample time for employee input.

Insurance renewals don’t have to be stressful, but failing to allow enough time for the process will leave you in a frenzy.

- The employee is always right.

Ok… so maybe the employee isn’t ALWAYS right (Pajama Fridays, anyone?). When it comes to health insurance benefits and providers, though, there’s no one better to ask about the value of your benefits plan than the people who are using it. They are the ones that you are trying to impress after all.

A great way to get valuable feedback on your health plan is to send out a survey to collect employees’ thoughts. Maybe employees are generally happy with your plan and you don’t need to change much. On the other hand, your employees could be dealing with terrible customer service from your plan provider or they may have a strong desire for a benefit that you don’t currently offer. Knowing this information allows you to adjust your health plan to match the real needs of your employees while showing them that you truly care about their wellbeing. A win-win for employee retention and talent recruitment!

If you do decide to send out a survey, make sure to leave room for discussion. Asking employees to rate your company’s health plan on a scale of 1-10 is not nearly as valuable as knowing the specific reasons as to why your employees are pleased or discontent with your health plan offering.

- Not all plans are created equal.

While it might be safe to assume that your current HMO plan is the best plan option for your business, it also might not. Are you willing to take that risk?

Most businesses change from year to year, whether that’s gaining employees, having employees switch to part-time, facing more financial risk, etc. All of these changes can have an impact on the type of plan that works best for your company—or even the regulations that you may face.

Annual renewals are a great time for you to ensure that you are meeting all of the legal requirements for your size of business while also checking to see if your health plan is still inline with your budget, the industry, and your employees’ needs.

An easy way to explore whether a different type of plan might be right for you is with PHP’s easy Plan Finder Tool. This tool allows business owners to answer a few simple questions to determine what type of plan might be the best fit. If the result isn’t the type of plan that you currently offer, then it’s time for a conversation with your health plan provider or broker.

Annual renewals are also a great time to make sure you are getting the most value out of your health plan. Shop around and compare prices to see what provider can offer you the most value for your money.

Renew Your Health Insurance with PHP

Being a Fort Wayne-based provider, PHP has added benefits like local customer support for businesses, member discounts within the Fort Wayne community, and intimate knowledge of the Fort Wayne healthcare scene. All of these factors, help us to provide more value to our customers and set us apart from the national providers.

If you need help navigating the insurance renewal process, contact the friendly Hoosier staff at PHP. We take the stress out of the health insurance process by matching you with a health plan that’s the perfect fit for your unique Indiana business. And it doesn’t stop there! We pride ourselves on top-notch customer service for members, too, so you can trust that your employees will experience only the best with your PHP health plan decision.

Contact PHP today to schedule a consultation for your health plan renewal.