Ancillary products: What they are and why employees want them

You may or may not have heard your insurance provider use the term ancillary products, but do you know what ancillary products are? Well, according to Insuranceopedia:

“An ancillary product is a product that is acquired as a bonus or add-on purchase when buying another product.”

PHP offers a variety of ancillary products that can be purchased in addition to your general health insurance coverage. These add-on insurance products include things like FSAs and HRAs. These are likely terms that you aren’t too familiar with, so let’s dig a little deeper.

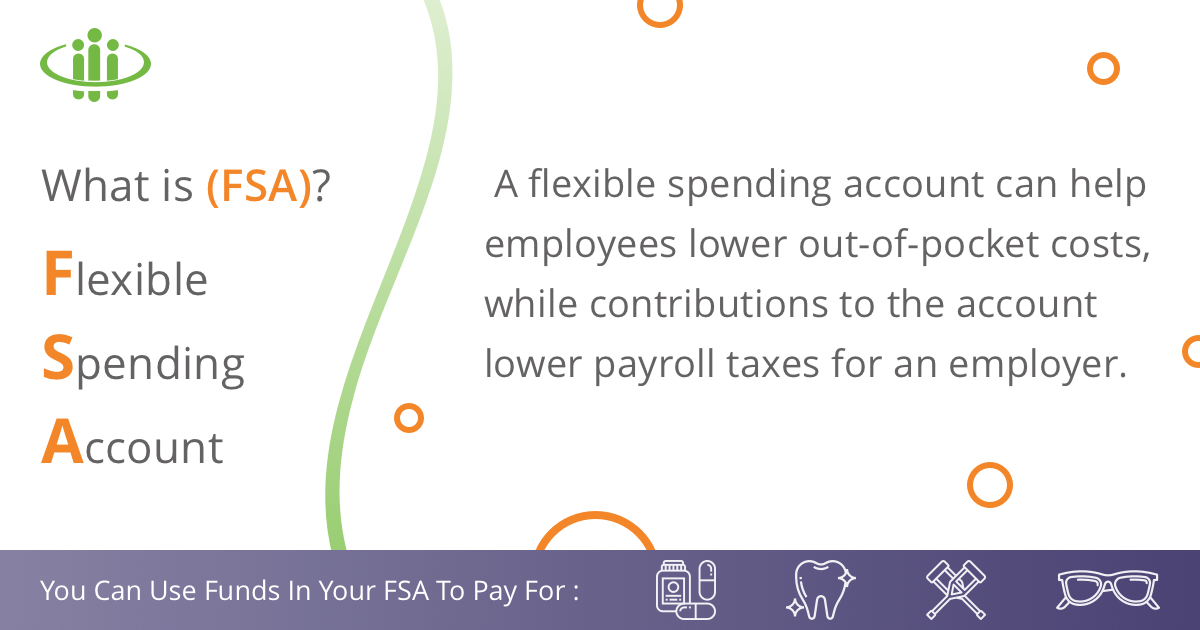

What is an FSA?

With a flexible spending account (FSA) employees have the option to contribute a portion of their paycheck pre-tax into a medical expenses account. Contributions to an FSA reduce the taxable income amount for both the employee and the employer—a true win-win!

In this scenario, employees have the option to set aside a portion of their paycheck pre-tax to be used towards approved medical expenses. As medical expenses come up throughout the year, the employee can then draw from this pool of money to help with both routine and unexpected medical bills.

FSAs are especially great for helping to pay for prescriptions, vision care, and dental care—3 things that are not fully covered by many basic health plans. This encourages employees to continue with preventive care in these areas, even if it is not specifically covered by their employer’s health plan.

Unexpected medical bills can add a lot of stress to an employee’s daily life. Giving them the option to save pre-tax money ahead of time can help alleviate this stress. Because of this, many businesses are choosing to add a FSA to their benefits package to improve employee morale and productivity.

What is an HRA?

An HRA or health reimbursement arrangement is an employer-sponsored health benefit which allows businesses to reimburse employees via check or direct deposit for certain types of health-related expenses in exchange for a tax benefit with the IRS.

With an HRA, an employee pays for a medical expense and then submits that expense to their employer for reimbursement. The IRS has created a list of eligible expenses for reimbursement, but each employer can set their own rules based upon what will or will not be covered under their HRA health benefit as long as it remains within the rules of the IRS.

HRAs are a great option for businesses that can’t afford any surprises in their healthcare expenditures because companies set the guidelines for what the HRA money can be used for and what the max amount is that an employee can request for reimbursement in a given year. Companies also get to decide whether that money rolls over and whether it can be used for just the employee or for immediate family members of the employee as well.

As we mentioned before, this is a great option for businesses who want to offer a health benefit to their employees, while still controlling their out-of-pocket costs in a practical way. It’s also a great way to go above and beyond in showing that you care about your employees, which will likely lead to increased employee retention and satisfaction.

Want to find out more?

If you’re looking to make the most out of your benefit plan and reduce your tax cost, HRA and FSA options are two great options to consider. PHP can help by assisting in your healthcare plan selection, providing plan documents, educating employees, and conducting all of your plan administration (including the distribution of all required forms).

Simplify your health plan selection and administration by contacting your local PHP health insurance experts. We make it easy to provide your employees with the health plans that they desire.